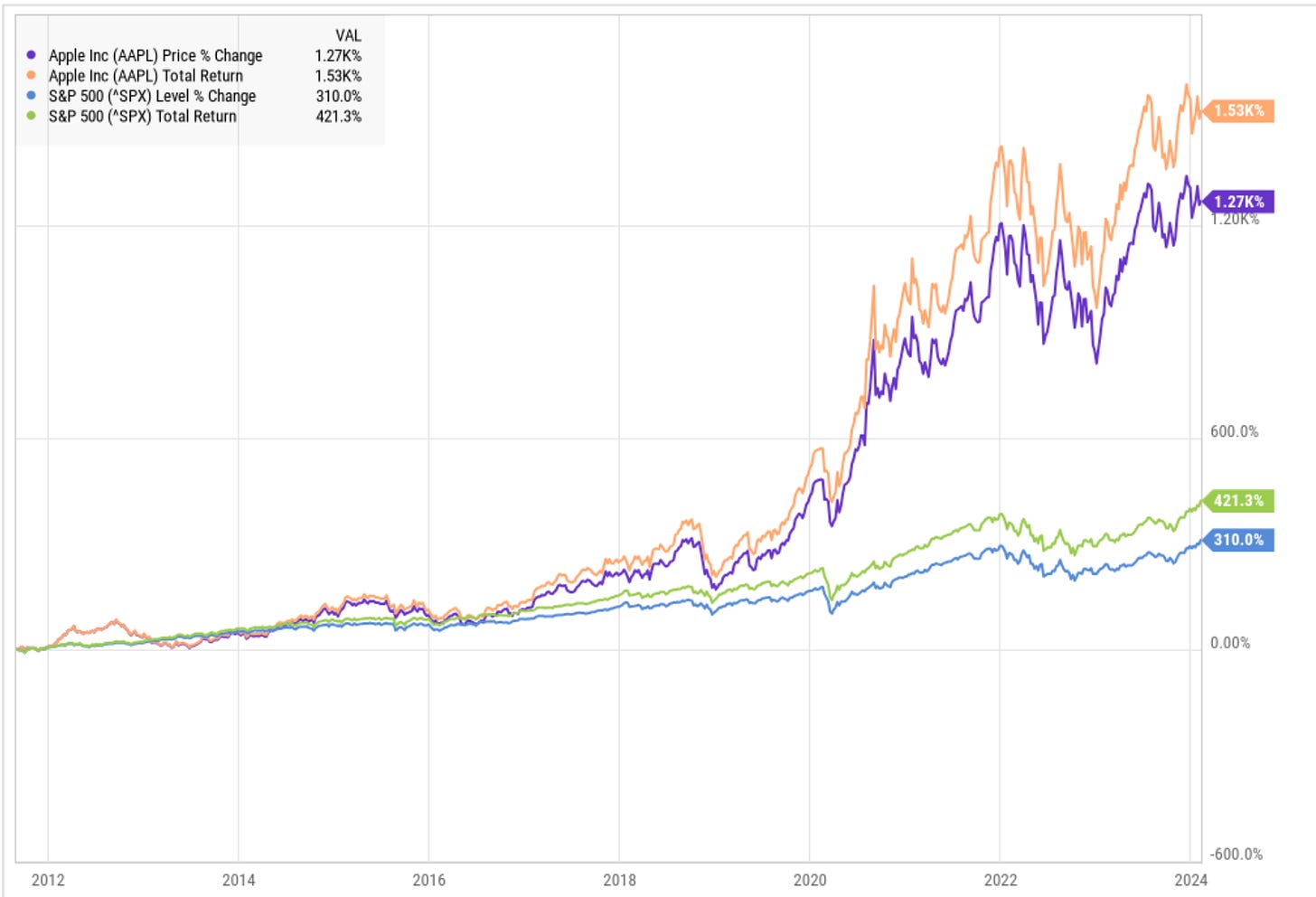

Few companies have mastered modern consumer technology - and reaped the attendant rewards - like Apple. From the moment Steve Jobs introduced the iPhone in 2007, Apple redefined not just a product category but ushered in the arrival of the now dominant computing platform: mobile. Over the next decade, Apple’s aggressive expansion into tablets (iPad), wearables (Apple Watch), and services (Apple Music, Apple TV+, iCloud, etc.) solidified its position as the premier global consumer electronics company.

Apple’s most recent earnings demonstrate its continued dominance. Phone sales were down nearly 1% from the prior year to $69.1 billion, yet overall revenue reached a record $124.3 billion, thanks to record performance in Services. Though the iPhone remains central to Apple’s strategy, it is Services - iCloud, Apple TV+, Apple Music, and AppleCare - that continue to prop up the company’s overall growth and margins.

The End of Interesting

If the Jobs era was defined by intuitive leadership, the Cook era represents the epitome of management science. Apple today excels at optimizing existing product lines and maintaining an annual cadence of iPhone, iPad, and Mac refreshes. Meanwhile, its design language and hardware-software integration remain polished to near perfection. This approach has proven extraordinarily profitable and stable. Under Tim Cook, Apple has expertly managed its supply chain, raised profit margins, and turned the once-modest services division into a juggernaut.

Ironically, that same operational prowess can and has inhibited the sort of radical risk-taking that characterized Apple’s earlier days. When billions in quarterly profits flow from the iPhone and Services, there is every incentive to maintain the status quo and avoid cannibalizing existing revenue streams (the iPad’s perpetual state of limbo is a prime example).

Apple stands at an inflection point. Its earlier triumphs have become constraints, limiting the bold experimentation that once characterized the company. Indeed, on the latest evidence, Apple appears to be struggling to balance protecting its immensely profitable iPhone-and-services empire with the desire to capitalize on new frontiers such as AI, AR, and autonomous vehicles.

As per Mark Gurman's report last week, Apple recently canceled the development of its AR glasses. Initially conceived to pair with iPhones, that approach was abandoned due to the processing demands it would place on the phone. The final version would have paired with Macs instead but was ultimately canceled altogether. The project's trajectory illustrates how large Apple’s fear of upending its existing product line -particularly the iPhone - still looms.

The Lengthened Shadow

Ralph Waldo Emerson famously remarked that “an institution is the lengthened shadow of one man,” and in Apple’s case, the man is Steve Jobs. Even long after his passing, Apple still reflects Jobs’s at times maniacal pursuit to perfectly meld form and function. Yet the company has also evolved - arguably out of necessity - beyond the idiosyncratic brilliance of one visionary. Under Tim Cook, Apple has embraced a distinctly managerial ethos. This pivot is not unique to Apple: it illustrates a broader pattern in which a founder’s shadow looms large, eventually giving way to a more measured, process-driven era.

You can see similar handoffs at Microsoft, where Bill Gates’s PC-centric vision peaked during Steve Ballmer’s tenure, and then gave way to Satya Nadella’s leaner, cloud-first agenda. In either case, a founding vision eventually encounters the gravitational pull of routine, market share, and risk aversion.

Apple’s transition may be more scrutinized because of just how thoroughly Jobs’s genius seemed to define the brand. Where once the company shattered expectations with the iMac, iPod, iPhone, and iPad, it now optimizes and fortifies an existing empire. Nonetheless, Apple’s recent track record - marked by the abandoned Apple Car, canceled AR glasses, and cautious AI moves - suggests that operational excellence may continue to trump radical experimentation. The company’s redoubt of iPhones and Services reliably shields it from short-term volatility, but it also risks blinding Apple to the next paradigm shift.

Apple, despite its scale, still operates under the long shadow of its founder, and it’s far from clear whether the Cook-era institution can transcend that legacy in a truly disruptive way. The question is whether Apple will find the resolve to risk its present to create the future - or remain content refining the extraordinary formula that made it the world’s most valuable company in the first place.