A man is hidden behind his tongue.

Arab Proverb

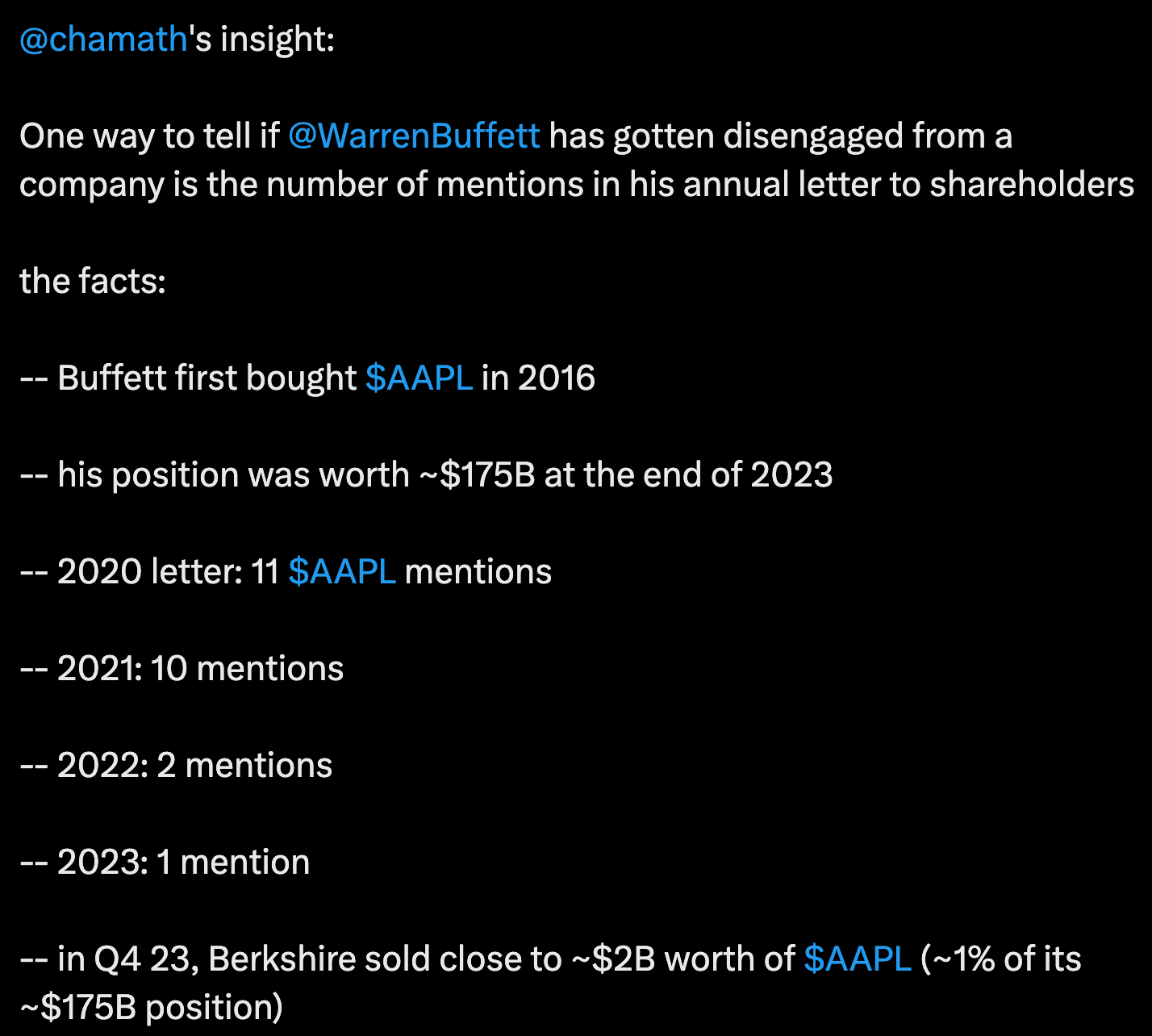

Earlier this year, Chamath Palihapitiya highlighted a clever way to determine whether Buffett was letting go of his Apple position:

From what I could ascertain, surprisingly little work has been done on parsing shareholder letters. As a starting point, I thought it would be worthwhile to perform a basic word count analysis on the letters from Buffett, Bezos, Brin, Page, and Huang to see if it afforded any additional insights into the minds of those operating in full-on “Founder Mode”. 1

The letters used were as follows:

Berkshire Hathaway Shareholder Letters (1977 - 2023)

Amazon.com Shareholder Letters (1997 - 2020)

Google (Alphabet) Founders’ Letters (2004 - 2017)2

NVIDIA’s Stakeholder Letters (2011 - 2024)

The results don’t hold any predictive value but are pretty revealing nonetheless.3

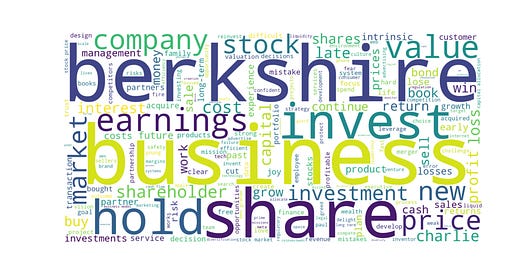

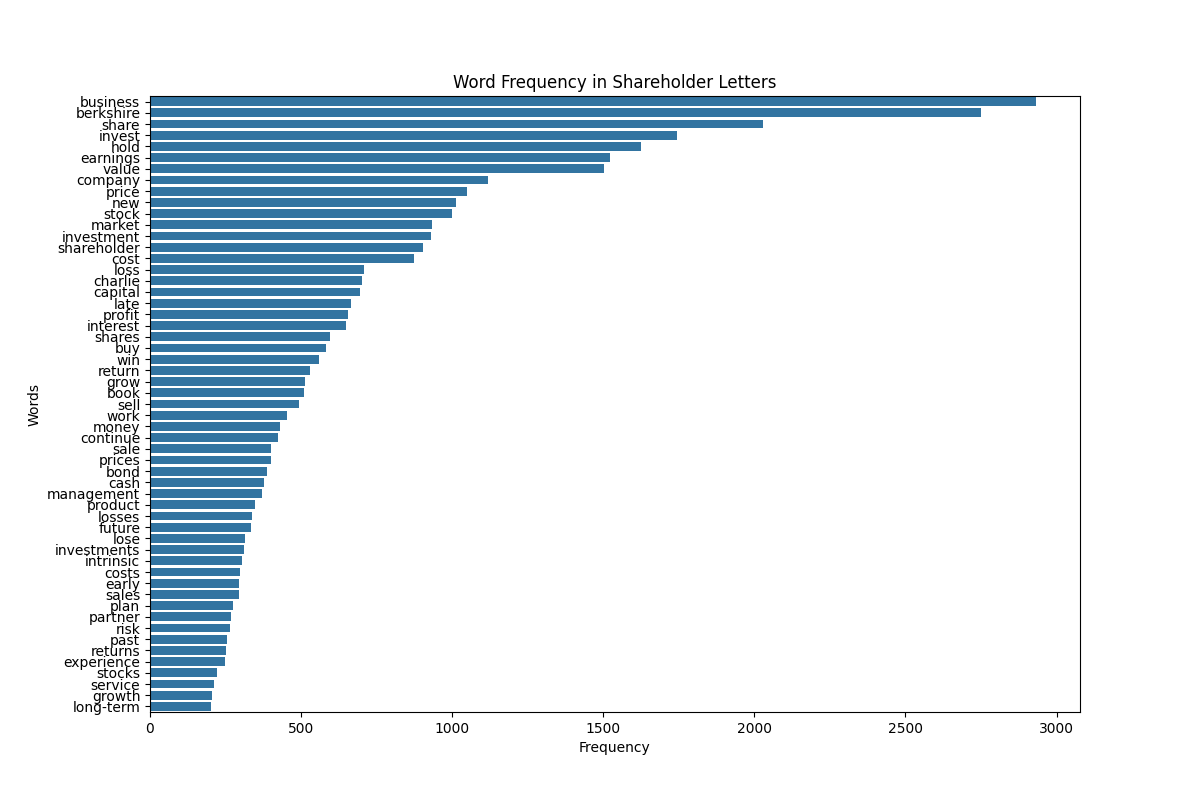

Berkshire Hathaway Shareholder Letters (1977 - 2023)

Whenever Charlie and I buy common stocks for Berkshire's insurance companies (leaving aside arbitrage purchases, discussed [in the next essay]) we approach the transaction as if we were buying into a private business. We look at the economic prospects of the business, the people in charge of running it, and the price we must pay. We do not have in mind any time or price for sale. Indeed, we are willing to hold a stock indefinitely so long as we expect the business to increase in intrinsic value at a satisfactory rate. When investing, we view ourselves as business analysts—not as market analysts, not as macroeconomic analysts, and not even as security analysts. Our approach makes an active trading market useful, since it periodically presents us with mouth-watering opportunities. But by no means is it essential: a prolonged suspension of trading in the securities we hold would not bother us any more than does the lack of daily quotations on World Book or Fechheimer. Eventually, our economic fate will be determined by the economic fate of the business we own, whether our ownership is partial or total.

Lawrence A. Cunningham. The Essays of Warren Buffett (p. 137). Kindle Edition.

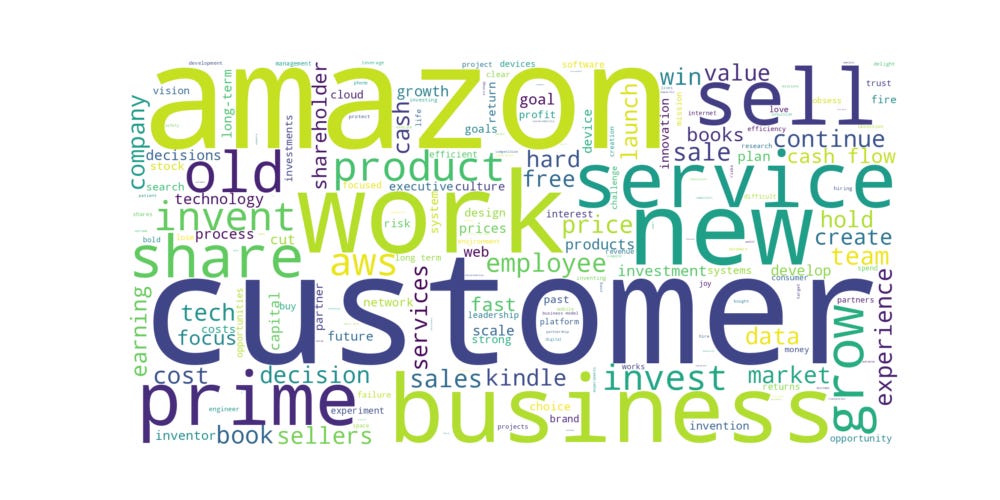

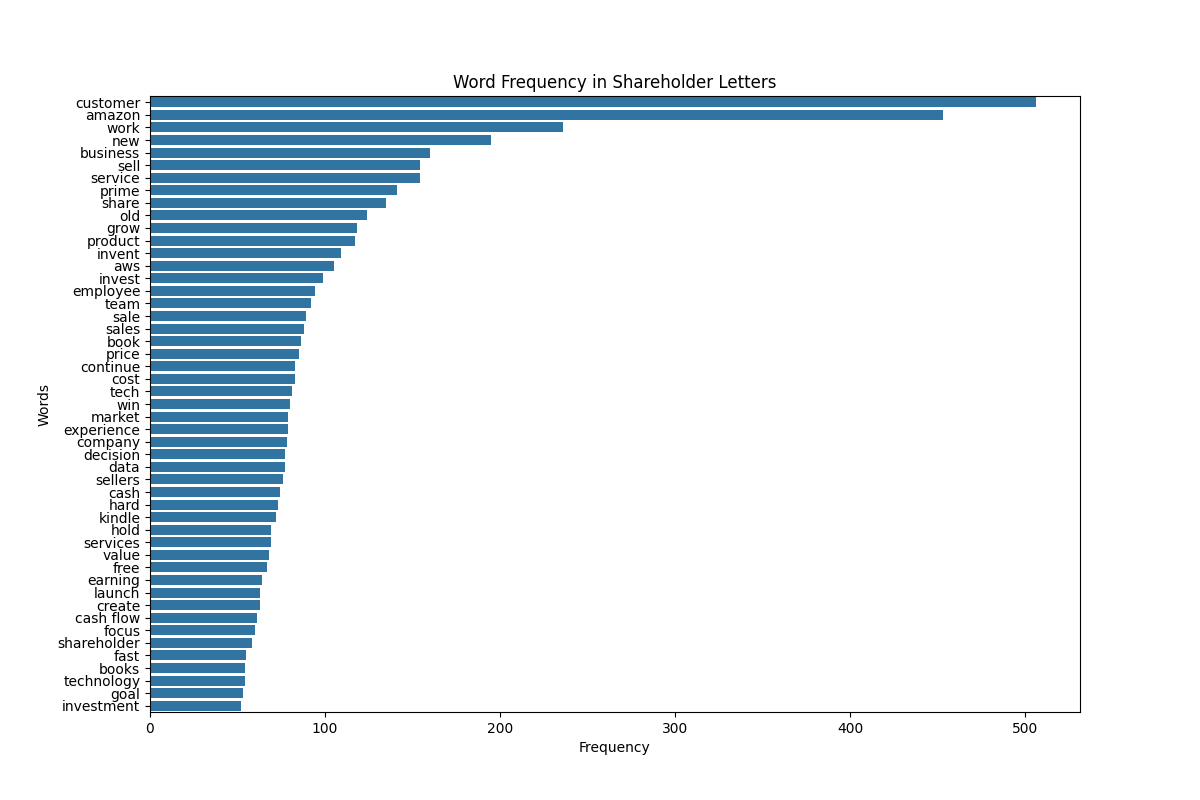

Amazon.com Shareholder Letters (1997 - 2020)

We intend to build the world’s most customer-centric company. We hold as axiomatic that customers are perceptive and smart, and that brand image follows reality and not the other way around. Our customers tell us that they choose Amazon.com and tell their friends about us because of the selection, ease-of-use, low prices, and service that we deliver. But there is no rest for the weary. I constantly remind our employees to be afraid, to wake up every morning terrified. Not of our competition, but of our customers. Our customers have made our business what it is, they are the ones with whom we have a relationship, and they are the ones to whom we owe a great obligation. And we consider them to be loyal to us—right up until the second that someone else offers them a better service.

Jeff Bezos. Invent and Wander (p. 67). Kindle Edition.

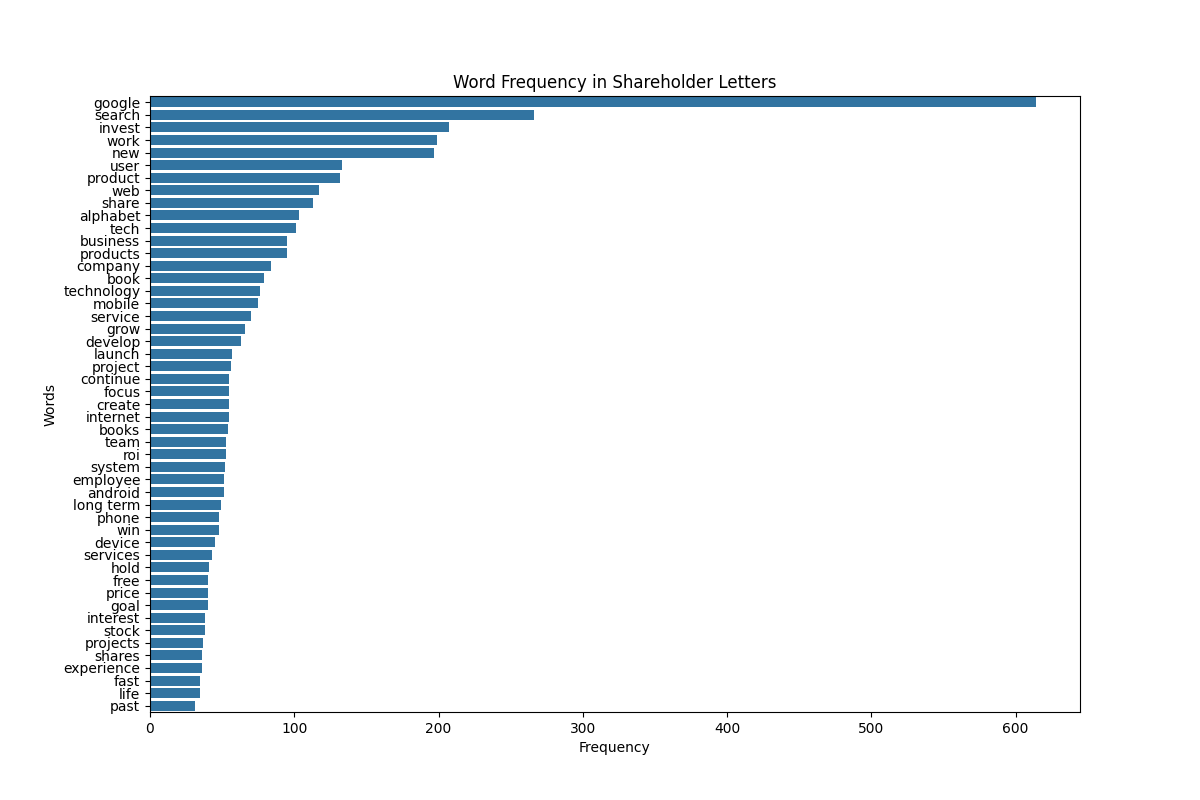

Google (Alphabet) Founders’ Letters (2004 - 2017)

Google’s business model has remained remarkably profitable since its founding. With the advent of AI-enabled search, whether it will remain as profitable is an open question.

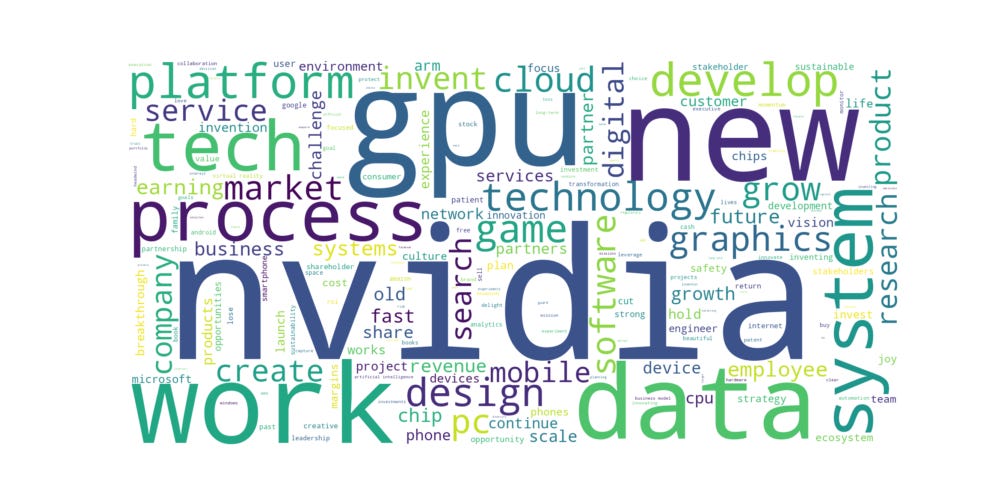

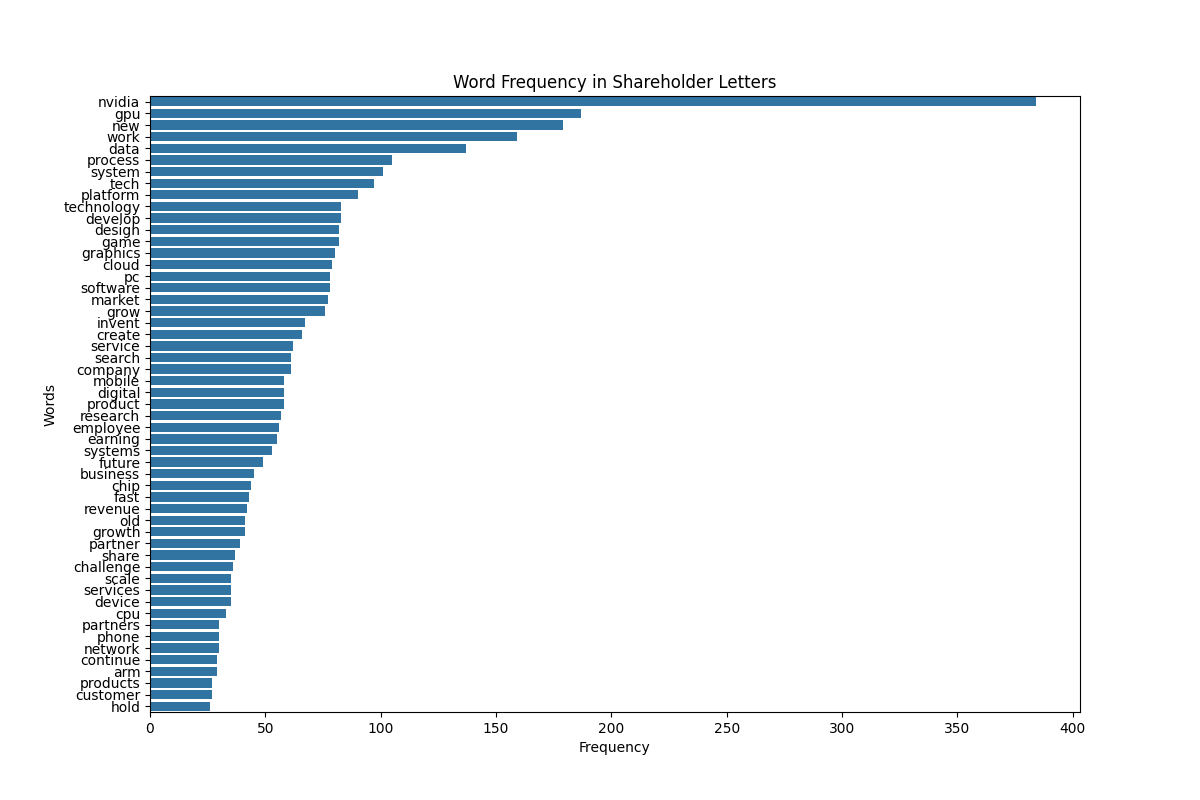

NVIDIA’s Stakeholder Letters (2011 - 2024)

Jensen Huang is renowned for being extremely technically competent, eschewing heirarchy, and focusing most of his time working with NVIDIA’s engineers to solve the company's most pressing challenges.

I used the following Python libraries:

PyPDF2

nltk

pandas(pd)

Matplotlib and seaborn

Wordcloud

I was unable to locate letters from Gates or Zuckerberg.

Google’s earlier letters were authored by both Sergey Brin and Larry Page. Letters from 2011 onwards were penned by either. For simplicity, I treated them all identically.